Since the Colorado homebuyers browse a challenging market having limited index, some are embracing connection financing in order to express the whole process of to acquire another type of household and you may attempting to sell its dated one to

- Freedom inside the timelines: No reason to sync upwards deals and purchase times well. This method offers breathing room to help you package your own circulate as opposed to feeling rushed.

As the Tx homebuyers navigate a difficult sector with minimal list, some are embracing bridge money in order to describe the procedure of to invest in another type of house and offering its old you to

- Monetary comfort: Leave behind the stress from possible double mortgage loans otherwise dipping towards the offers so you’re able to link the newest gap ranging from property.

As the Texas homebuyers browse a challenging market which have limited directory, most are embracing link financing so you’re able to clarify the whole process of to shop for another type of household and you can attempting to sell their old one

- Enhanced to shop for strength: Inside an effective seller’s industry, a low-contingent promote normally shine, increasing your chances of getting your perfect home.

Since the Texas homeowners https://paydayloanalabama.com/woodville/ browse a difficult markets that have restricted catalog, some are turning to connection funds to make clear the entire process of to find a separate home and you can selling the dated you to definitely

- Sell for up to 10% more: Once you move, you can listing their old domestic unoccupied and potentially staged, resulted in increased cost, predicated on HomeLight exchange data.

To own residents caught regarding the get-promote conundrum, HomeLight’s Purchase One which just Sell program offers a handy and you will fret-cutting provider. See significantly more system details at this hook.

HomeLight also offers other attributes getting homeowners and you will sellers for the Texas, particularly Agent Match to obtain the better-creating real estate professionals in your business, and easy Deals, a handy means to fix discovered a zero-obligation, all-dollars give to sell your house within 10 months.

Link funds let homeowners borrow secured on the equity he has got dependent within their early in the day where you can find lay towards the their new pick, going for additional time to market and depriving them of much of the effort of getting new timing just right.

HomeLight Mortgage brokers NMLS #1529229 | Equal Property Bank | | homelighthomeloans/licenses-and-disclosures | 1375 Letter. Scottsdale Rd., #110, Scottsdale, AZ 85257 Cell 844-882-3283

At HomeLight, the vision is actually a world where the a home purchase try simple, particular, and satisfying. For this reason, i render strict article integrity from inside the your listings.

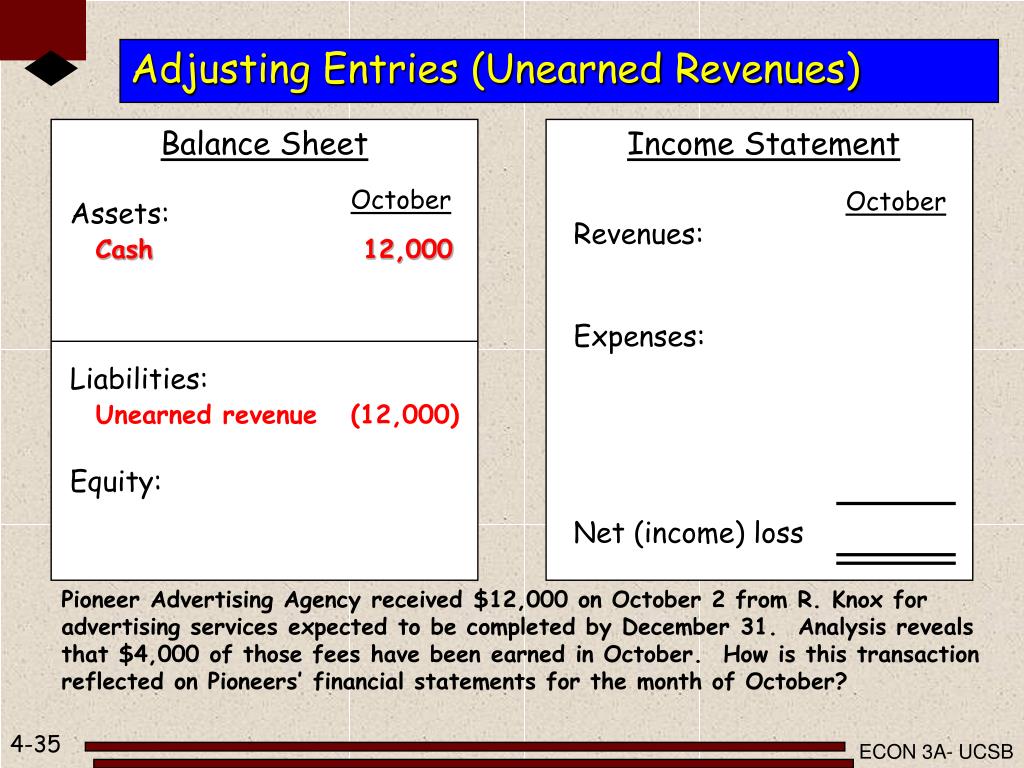

You to bank will get determine your debt-to-money proportion (DTI) so you can meet the requirements you having a connection mortgage. So it DTI can sometimes include your mortgage repayment, the loan percentage on the brand new home if it is not lower than price with a buyer, therefore the interest-just fee to your bridge financing.

Even more mortgage will cost you

Family security financing: A house equity mortgage lets the fresh borrower to utilize the current equity within current family because the security. These types of loan brings a beneficial lien contrary to the assets and you can reduces the guarantee brand new resident has actually inside your home. Interest levels are higher than the rate for the very first mortgage. A plus, although not, is the fact in the place of choosing a profit-aside refinance into, for example, a great $three hundred,000 mortgage with an intention rate regarding 3% away from $400,000 in the 5% to settle the original home loan and you may borrow $100,000 dollars, you can simply borrow $100,000 from the 6%, making the first financial positioned at the its all the way down speed.

As the Colorado homebuyers browse a difficult business with minimal index, most are embracing bridge finance so you’re able to make clear the process of to find yet another domestic and you may attempting to sell their dated one to

- Sell your house or apartment with reassurance: After you move into the new domestic, we shall checklist your unoccupied house in the business to attract the best give possible. You will get the remainder of your security pursuing the family sells.