With respect to your bank account along with your obligations, individuals are some other. Some individuals just have that credit card to deal with, whereas someone else features numerous referring to prior to we actually imagine other types of obligations like unsecured loans, unpaid expense and you will automobile repayments.

Controlling numerous bills will be hard, however it will be difficult while in the a cost-of-lifestyle crisis. Especially if you feel just like all your valuable income is put to pay off expense and you are clearly not able to save as often as you wish so you’re able to.

When you are balancing numerous month-to-month money and would like to take over of funds, debt consolidation can be advisable for you. It might help save you some funds, also!

What exactly is debt consolidation reduction?

Put another way, debt consolidation integrates your present bills together in a single financing: constantly a personal loan. By firmly taking aside a new personal loan, you could pay their almost every other balances owing and relieve the newest number of costs you have to make.

Let me know way more!

Such, say you really have three handmade cards with expenses regarding $dos,000, $step 3,000, and you may $4,500, most of the out-of more banks, all payday loan near me of the with various rates, payment wide variety and you will payment dates. Which is too much to monitor which can be before you could create people present unsecured loans it is possible to already have on mix!

Because of the simplifying the debt on the that consumer loan, possible only have one to interest to think about and something payment to make for each and every period. Personal loan interest levels are less than bank card costs too, so that you ount is shorter. As well as, the expression of the the newest mortgage you will imply you have offered to settle your debt hence you will subsequently beat your cost amount, also.

Is debt consolidation personally?

Just as in something regarding your profit, you really need to very carefully believe debt consolidating because of before you take the new leap. To create an educated decision from the taking out an effective personal loan to possess debt consolidation reduction, evaluate these advantages and disadvantages:

- One continual installment.

- You to definitely interest (always repaired not adjustable).

- Better command over your allowance and earnings.

- More time to settle your debt (term dependent).

- A longer title you will suggest you only pay also living of the loan.

- As with all the finance, your credit score would be influenced if you’re unable to create your payments.

- Lowest borrowing from the bank count could be higher than you want.

What’s the initial step?

One of the first steps you can take should be to do the maths. Feedback all of your debt and you can assess just how much you borrowed from now. Including, check how long it is likely to elevates so you’re able to pay your debt, just how much you may be purchasing in the even more charge and you may costs, and exactly how much interest you happen to be using (and so are anticipated to pay along side lifetime of brand new finance). Like that, you will see an entire knowledge of just what lays to come and you may if a debt negotiation loan is right for you. You might find by using a debt negotiation mortgage, you’ll clean out too many costs and you may charges at the an excellent minimal.

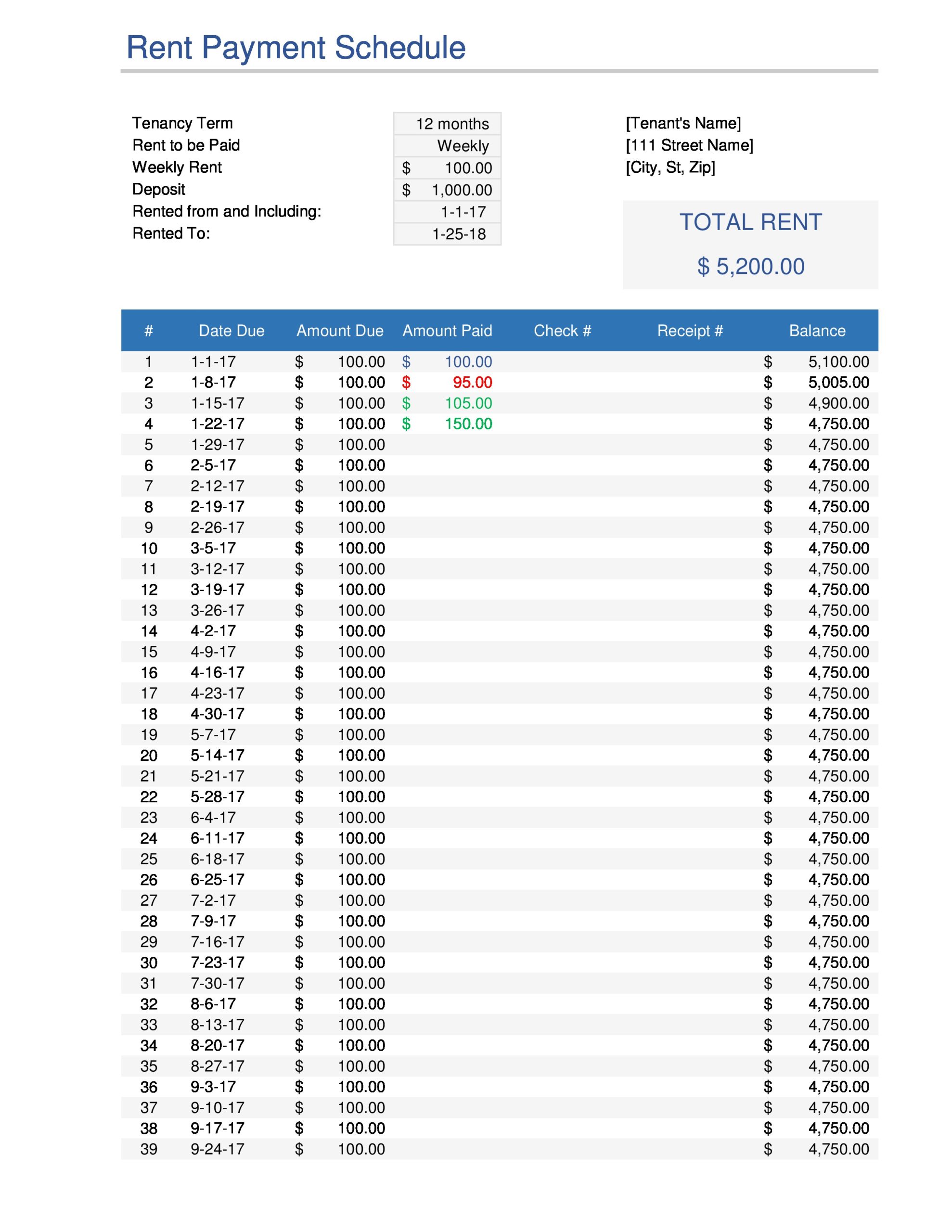

Use our very own mortgage cost calculator observe just how much your costs was, the difference the loan name tends to make to help you how much your shell out, and just what impact expenses a week in the place of monthly might have.

The Unsecured Unsecured loan try a fixed rates mortgage that offers you a choice of financing term (from a single to help you eight decades). You will know just how much your payments might possibly be and does not have to worry about rate transform. Do not charge a fee charge in making more repayments into financing, so if you have to pay it back ultimately, you could do one instead of punishment. And, when you do generate extra repayments, we provide the capability to supply those funds and you may redraw it without difficulty!

Obtaining a personal bank loan out of P&N Lender is easy. You could implement on the internet, call our very own amicable cluster for the 13 25 77 otherwise see your nearest branch.

Banking and you will Borrowing from the bank facts approved of the Cops & Nurses Restricted (P&N Financial) ABN 69 087 651 876 AFSL/Australian Credit Permit 240701. One pointers doesn’t account fully for their expectations, financial predicament or requires. Browse the related T&Cs, in advance of getting apps otherwise obtaining people product, inside the provided and you will deciding should it be good for you. The mark Field Determinations (TMDs) arrive here or through to request.