A lot of people have no idea about the credit reporting program-way less the credit score-until they attempt to pick a house, remove that loan first off a business or generate a biggest get. A credit history is often an excellent three-fist matter one to loan providers use to help them determine whether your score a mortgage, a charge card or another credit line, in addition to interest you are billed for it borrowing. The latest get is actually an image of your as a credit exposure on financial in the course of your application.

Everyone has actually his very own credit history. When you’re married, you and your partner gets just one rating, so if you’re co-signers to the that loan, one another score could well be scrutinized. The riskier you appear on the financial, the brand new more unlikely you’re to get credit or, if you find yourself accepted, the more one borrowing from the bank can cost you. In other words, might pay even more in order to borrow money.

Ratings cover anything from whenever three hundred in order to 850. In terms of securing from inside the mortgage, the better your own score, the higher the new regards to borrowing you are likely to receive.

Now, you really are wondering “In which would We stand?” To resolve that it matter, you might request your credit score (in which there is certainly a charge) otherwise 100 % free credit file regarding (877) 322-8228 or annualcreditreport.

By far the most really-known credit rating program was created by Reasonable Isaac Organization and is called the latest FICO get. The 3 biggest credit agencies-Equifax , TransUnion and you may Experian -use the FICO scoring model for their exclusive assistance. As the for each scoring program uses a somewhat different statistical design, their rating regarding all the three are not exactly a comparable. It is because loan providers or any other businesses declaration recommendations to the credit agencies in a different way, therefore the organizations may establish you to definitely information as a consequence of the proprietary systems in a different way.

Because the other lenders keeps various other requirements in making financing, where you’re relies on and therefore borrowing agency the financial converts to having credit ratings.

Just how Your credit score Has an effect on You

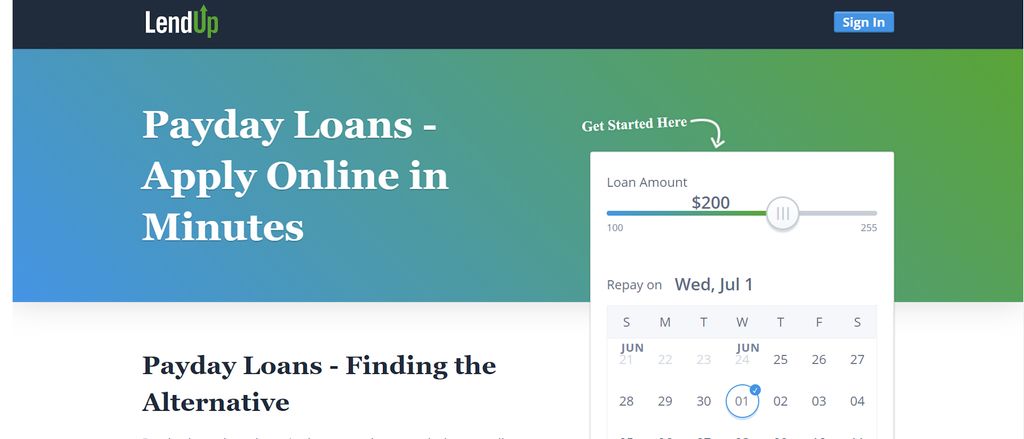

Guess we should use $200,000 when it comes to a fixed rates 30-season financial. If your credit rating is in the large classification, 760-850, a loan provider you will cost you step three.307 percent attention on loan. step 1 It indicates a payment of $877. If the, but not, your credit rating is in a lower life expectancy range, 620-639 instance, loan providers you will charge you 4.869 percent that would trigger a good $step 1,061 payment. In the event a bit respectable, the lower credit rating perform charge you $184 1 month significantly more to suit your mortgage. Across the life of the loan, you will be spending $66,343 over if you had a knowledgeable credit score. Considercarefully what you can do with this even more $184 four weeks.

Deciding Your credit score

Therefore, how can credit agencies dictate your credit score? Reasonable Isaac is rolling out an alternative rating program for every away from the 3 credit agencies, using following the four components into consideration:

What Support and you may Hurts a credit rating

- Commission History details the reputation paying back your financial situation promptly. It parts encompasses your payments to your credit cards, shopping membership, installment finance (particularly auto otherwise college loans), finance company profile and you will mortgages. Public records and you can reports explaining like affairs while the bankruptcies, foreclosure, caters to, liens, judgments and you can wage attachments are also noticed. A track record of timely payments of at least minimal matter due helps the get. Later otherwise overlooked costs damage your score.

- Wide variety Owed otherwise Borrowing from the bank Usage reveals just how profoundly in debt your is actually and you may contributes to deciding if you possibly could manage everything owe. If you have highest outstanding balances otherwise are almost “maxed away” in your credit cards, your credit score could be adversely inspired. A rule of thumb is not in order to go beyond 31% of borrowing limit towards the credit cards. Repaying a cost financing is considered which have favor. Like, if you borrowed $20,000 to purchase a motor vehicle and get paid off $5,000 of it timely, even though you however are obligated to pay a considerable amount to the brand new financing, your fee development yet reveals in charge loans management, hence definitely affects your credit score.

- Length of Credit rating makes reference to how much time you have got had and you will used borrowing. The longer your reputation of in charge borrowing from the bank administration, the greater your own rating might be as loan providers provides a far greater possibility to see your payment development. For those who have paid down on time, every time, then you will browse for example an excellent of this type.

- Style of Borrowing from the bank issues new “mix” out-of credit you availableness, including handmade cards, merchandising membership, installment loans, finance company account and you will mortgage loans. You don’t have to possess each kind out of account. Alternatively, so it grounds takes into account various types of borrowing from the bank you have and you can whether you utilize you to credit correctly. Such, using a credit card to invest in a boat you will damage the score.

- Brand new Borrowing from the bank (Inquiries) signifies that you really have otherwise are about to take on much more debt. Beginning of many borrowing accounts inside the a preliminary length of time is also feel riskier, specifically for those who do not have a long-oriented credit score. Each time you apply for an alternate credit line, one software counts as the a query or good “hard” hit. Once you price search for home financing or an auto loan, there might be numerous concerns. Yet not, because you are seeking singular financing, issues of the kinds in any fourteen-big date months matter due to the fact just one hard hit. In comparison, trying to get several playing cards in the a brief period of energy have a tendency to amount just like the several hard attacks and you can potentially reduce your get. “Soft” hits-as well as your private request your credit history, requests off lenders to get you to “pre-approved” borrowing from the bank even offers and https://www.paydayloancolorado.net/moffat the ones via employers -doesn’t apply to your rating.

Good credit Throws Money into your Pouch

Good credit administration contributes to high fico scores, which in turn lowers their pricing so you can acquire. Lifestyle within your mode, using personal debt intelligently and you may expenses all the expenses-along with bank card minimal repayments-timely, whenever is actually smart monetary moves. It assist in improving your credit score, slow down the matter you have to pay for money you acquire and you will lay more funds on your own wallet to save and invest.