How house security mortgage repayment work

Ashley Donohoe is actually an expert into the personal finance, lending, and you will borrowing from the bank administration having almost a decade of expertise creating and editing content when it comes to those components. Professionally, this woman is an official bookkeeper on the National Bookkeepers Connection and you will supported within the an advisory role having Zacks Individual Fund.

Charlene Rhinehart is actually a specialist when you look at the bookkeeping, financial, paying, home, and personal money. She actually is a good CPA, CFE, Chair of your Illinois CPA Area Individual Income tax Panel, and you can are recognized as among Behavior Ignition’s Ideal fifty women inside bookkeeping. She actually is the brand new inventor regarding Wealth Females Every single day and you will an author.

Property collateral financing is actually a swelling-share second mortgage you to lets you borrow against the personal loan Columbus property’s collateral. As with one financing, you’ll need to pay back the funds according to terms of the borrowed funds.

Domestic collateral mortgage payments generally was fixed costs more than an appartment time period. Observe domestic equity loan cost work, how you can calculate your instalments, and more in the choice to creating regular repayments.

Secret Takeaways

- Domestic collateral financing costs start shortly after you close toward financing.

- Costs generally speaking last for four to three decades, according to mortgage label.

- The degree of your own payment utilizes the word, interest, and you may amount borrowed.

- Through the fees, you can re-finance toward other tool, such as for example various other home guarantee mortgage otherwise a unique home loan.

What things to Discover Home Equity Financing Repayment

Once you romantic on the home equity financing, you will definitely begin making repayments inside a couple months out-of closure, since you manage which have a first mortgage.

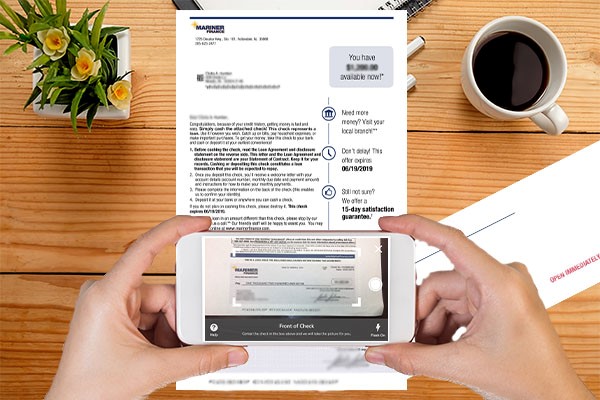

You need to discovered an announcement out of your financial all of the battery charging cycle, that’s generally speaking monthly and separate from your financial report. Which document boasts your payment deadline, percentage matter, rate of interest, balance facts, and you may payment discount. it may are the escrow and you will property tax advice.

How do Costs Performs?

You will need to complete the first commission by the deadline, which is generally speaking on the first day of your day. Part of their fee goes on the the new loan’s dominating, or totally new harmony, given that remainder goes toward notice. These financing fool around with simple attract instead of compounding interest. Additionally, house security funds try amortized, where extra money goes toward attract compared to the principal into the early part of the financing name.

You might be eligible for a tax deduction toward domestic equity loan focus when you use the money on the qualified home-related costs.

If you can’t help make your percentage because of the due date, their financial can offer a primary sophistication months to blow new loan one which just are at the mercy of late costs. Once 1 month, the financial institution can be statement the late payment for the around three chief credit bureaus, as well as your credit rating might take a bump. Immediately following 120 days, the financial institution usually can initiate the process of foreclosing in your family.

How will you Submit Costs?

You’ll be able to created automatic money or yourself create electronic payments using your lender’s portal. You’ll be able to usually have a solution to shell out because of the cell phone otherwise go to a department. If you enjoy to invest from the send, you are able to posting your percentage coupon which have a or money order to your bank.

How much time Must you Pay a house Equity Financing?

Your unique financing term determines your cost several months, and it may feel because short since 5 years or due to the fact long because the 30 years. Your monthly payments remain up until the mortgage balance has reached zero. Through to payoff, the borrowed funds not any longer counts up against the home’s collateral.