What’s the definition of a house security loan? Property collateral loan is just exactly what it feels like a loan that uses your home guarantee once the equity. When your domestic secures that loan, they affects your in two suggests your guess some exposure since if your fail to make your costs, the lending company can be foreclose and take your residence. But as the household guarantee fund try much safer so you’re able to loan providers than unsecured loans (for example unsecured loans or playing cards), they arrive that have lower interest levels.

This short article talks about an informed purposes for a home security financing, home collateral financing rates of interest and you can closing costs, and exactly how home security fund compare with bucks-aside refinancing.

What are the Best Purposes for property Security Loan?

Home collateral fund promote self-reliance they are utilized for almost things. However, house guarantee is actually a secured item, so you should treat it in accordance and obtain cautiously. Whenever you are getting a large lump sum out-of property collateral financing, the best ways to use the cash were compatible assets, long-title instructions, and you may debt consolidation.

What’s meant by a good investment? Generally, they are low-risk opportunities that deliver a rates away from come back or financial benefit that outweighs your home equity loan costs. So, some ways you might invest home equity loan proceeds include:

- University expenses on your own otherwise she or he

- Starting a business who has got a high odds of being winning

- Home improvements one incorporate value to your home

A college degree normally give a strong get back when it facilitate you have made more. Starting a corporate with household equity mortgage money could help you raise otherwise replace your latest income. And you can to make home improvements increases your own acquire if you decide to sell the house after. Meanwhile, you might be capable allege an income tax deduction towards notice repaid on the house guarantee financing.

In the event the household security loan helps you save or earn much more than simply it will cost you, it should be a no-brainer. Including high orders otherwise debt consolidating.

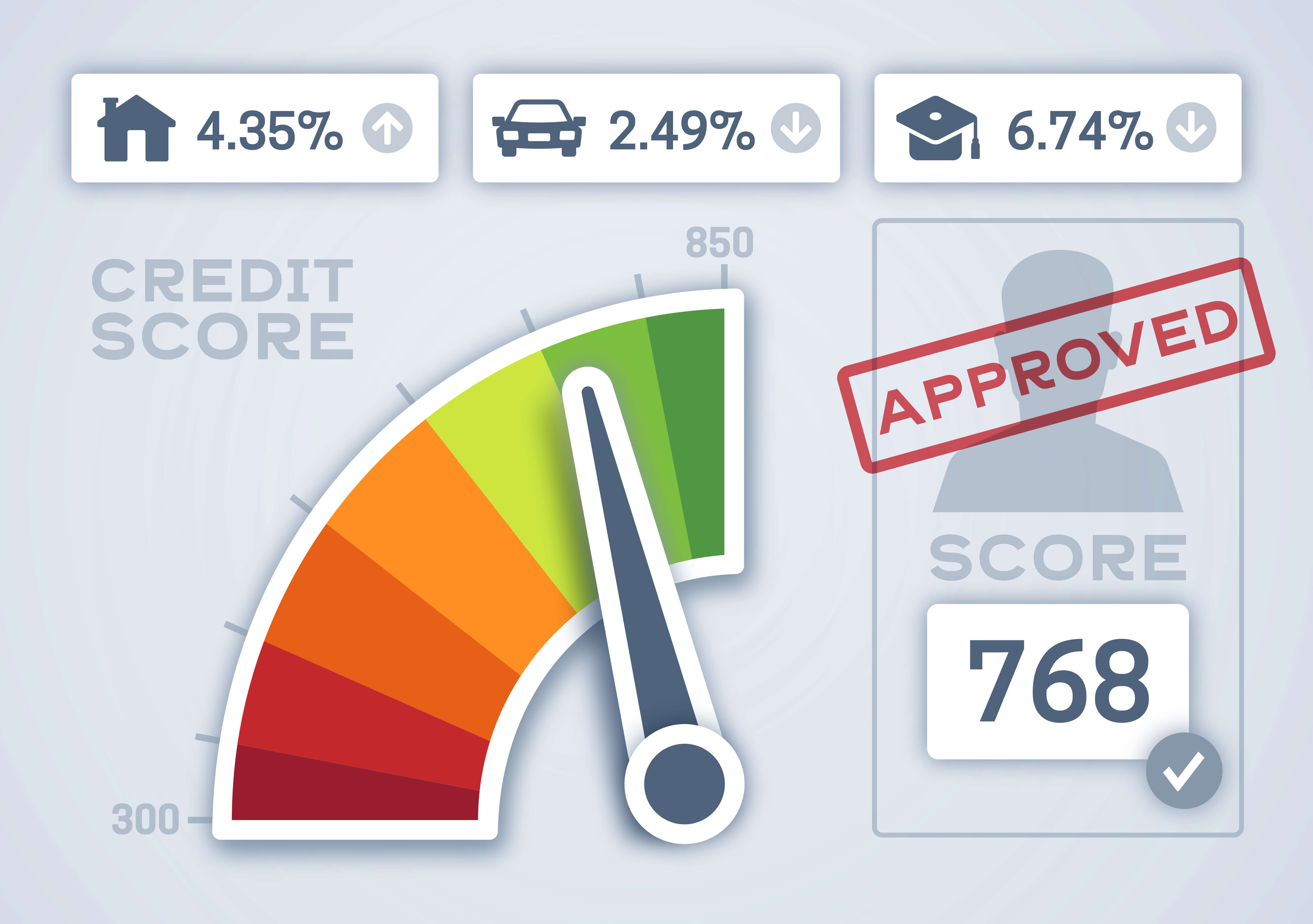

State you have got $20,one hundred thousand inside the credit card debt pass on round the five cards. An average Apr was %. You consider home guarantee loan interest levels and view these are generally hovering around 5%. Taking out a home collateral mortgage to consolidate people notes you certainly will help you save plenty of attention.

It assumes on you repay the balance as quickly as you can easily and don’t offer the latest installment. As even although you lose your own price regarding 16% so you can 5%, you will possibly not save money by firmly taking two decades so you’re able to pay off the borrowed funds. At exactly the same payday loans Divide time, you will not rescue for many who continue to fees on the cards without having to pay her or him completely monthly. Powering right up balances again will leave your tough away from than in the past.

What exactly are Shorter-High Purposes for Household Security Money?

Home equity is an asset. It represents the difference between what you owe on your home and what it’s worth. Accumulating equity in your home is generally considered one of the keys to building riches, so it’s not something that should be thrown away or wasted.

Just what exactly types of things would you n’t need to order with a house security financing? Essentially, the list includes issues that dont render one tangible monetary well worth. Such as for example:

- Expensive getaways

- A wedding

- Searching trips

It isn’t these particular everything is not needed you simply should get them which have reduced-identity financing. Unless you want to be investing in your wedding day in case your very first guy brains out to college or university. Listed here are choices: