- Antique Dollars-Out: Good for home owners which have at the very least 20% security.

- Jumbo Dollars-Out: Refinancing option for residential property which do not conform to lending limits set because of the Federal Construction Loans Service.

A finances-aside re-finance can be an experienced option for certain Tennessee property owners. You can utilize the cash to consolidate higher-appeal financial obligation or pay money for a costly medical procedure.

The fresh new proceeds from a money-out re-finance may also be used and make home repairs, such as for example including a screened-within the porch money to loan Crossville otherwise updating the fresh plumbing system. This can improve resale value of your property.

Without a doubt, there clearly was a drawback. (Is not here usually?) A money-out re-finance means big month-to-month mortgage payments and you will, usually, a high Annual percentage rate. If you cannot manage these changes, your exposure defaulting.

Cash-Away Re-finance vs. Home Collateral Financing: Which is Effectively for you?

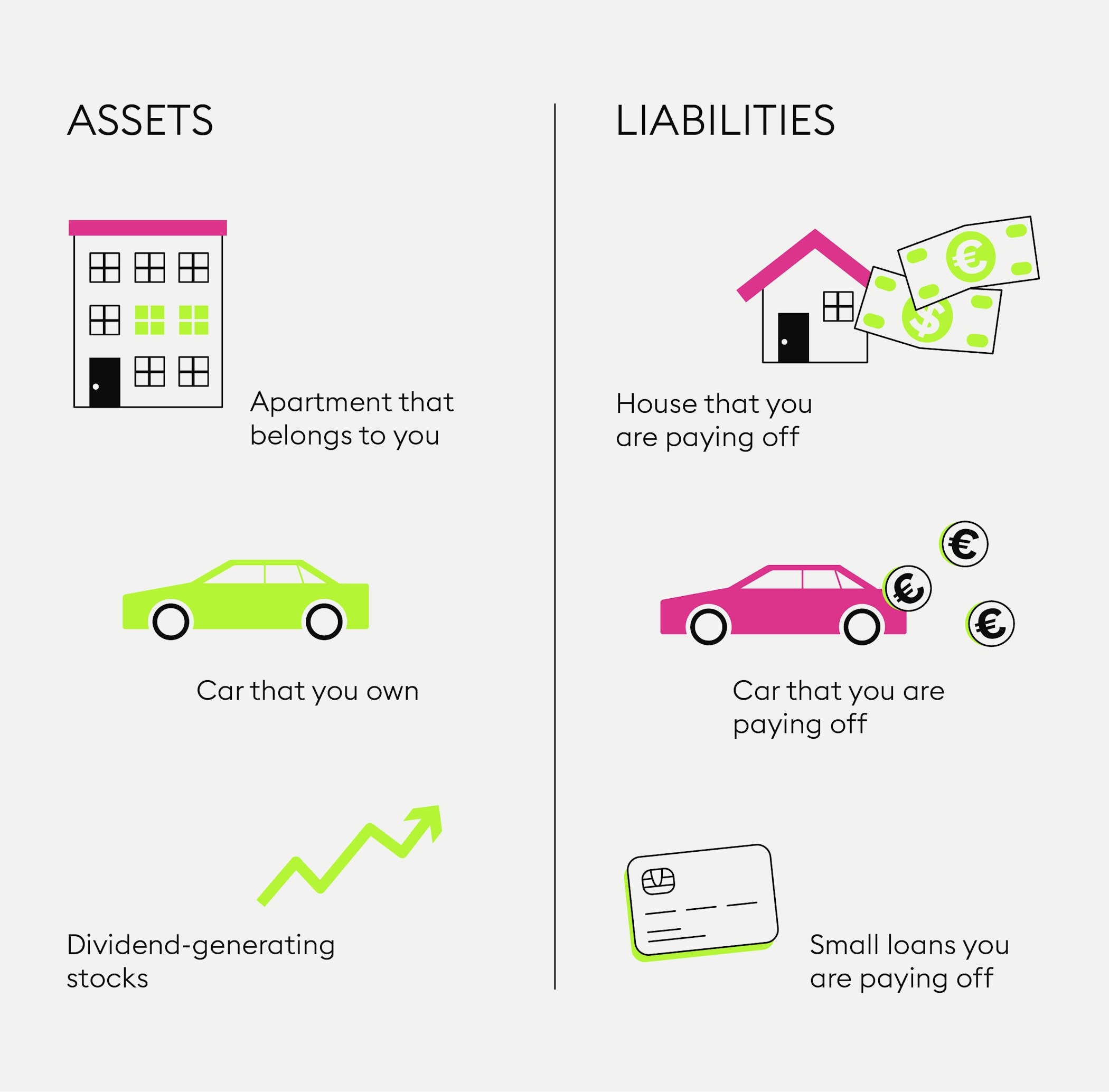

There are two main products that allow people benefit from their home equity: a cash-out refinance and you can a house collateral financing. These power tools are just like 2nd cousins similar but still very different.

Having a profit-out re-finance, you take aside a bigger home loan. So it financial pays your brand spanking new mortgage. Up coming, your pocket the difference.

But with a property equity financing, you take aside another mortgage with your residence’s collateral while the collateral. That implies you will be stuck juggling a few mortgages.

Both lending products enables you to spend money the method that you require. Pump the septic container. Purchase your youngster to visit school. Splurge with the a convertible. It’s your money, anyway. However, for individuals who default for the possibly a money-out financial or a home security mortgage, you chance dropping your house.

Tennessee people tend to adhere to a money-away re-finance because it is much easier. They only need to bother about you to payment maybe not two. However anybody roll with a house collateral mortgage to avoid costly closing costs.

Still, weighing your options? We could assist. Call us on the web otherwise by the calling [enter cell phone #] as connected with a home loan Advisor.

What Charges Are With the a money-Aside Refinance?

Perchance you want to repay the student education loans. Or, maybe you must holiday in Iceland. No matter your goals, it is important to look at the charge regarding the a money-out refinance.

As with a timeless re-finance, you’ll have to pay closing costs. These will cost you include dos% so you’re able to six% of one’s amount borrowed. Very, in the event your refinance loan is for $350,000, you certainly will pay ranging from $7,000 and $21,000.

It’s also wise to mull on individual financial insurance policies (PMI). For those who borrow more than 80% of the home’s well worth, you’re going to have to pay PMI. For many Tennessee property owners, PMI is actually between 0.55% to dos.25% of their new amount borrowed per year.

Additional factors To consider With a beneficial TN Cash-Out Re-finance

If you are drowning within the high-attract credit debt, we obtain they. You’ll be able to look for an earnings-out re-finance since an existence-protecting dinghy, bobbing available regarding the white-capped sea out-of adulthood.

- Default Risk: Sure, a finances-out refinance has its pros. However, it can also be extremely high-risk. If you can’t manage your new month-to-month home loan repayments, you exposure losing your property.

- Highest Rates of interest: A funds-away re-finance involves borrowing more funds. As such, such money include rates of interest that are 0.125% so you can 0.5% more than those of non-cash-away refinance mortgage loans.

- Bad Habits: Remember: For people who tend to live beyond your function, more funds would not augment you to definitely. In the event the some thing, a lump sum will allow you to spend a whole lot more.

Brand new Dashboard Refinancing Process

Let’s face it: Refinancing is normally a huge headache. That is because an average mortgage lender for the Tennessee helps to make the domestic money procedure needlessly tricky. Of course, if you have a concern believe us, you will mortgage officials never make a quick call.