FHA financing and you can traditional lenders are a couple of prominent variety of home mortgages, exactly what they actually mean often is undecided to not merely people in addition to suppliers. The difference ranging from FHA fund and you may conventional finance get smaller in order to enough activities between a customer’s credit score and you will downpayment to help you loan limits and assets conditions.

What is an enthusiastic FHA Financing?

FHA signifies http://www.elitecashadvance.com/installment-loans-wa/riverside/ the newest You.S. Government Casing Government, that was established in 1934 in order to build homeownership a whole lot more available for much more People in the us. Criteria to own people was smaller stringent compared to those to possess a traditional financing, for example, and you will mortgage issuers must be FHA-approved lenders. Meanwhile, the government claims the FHA funds against borrower defaults. In return, most of the FHA money need to adhere to the brand new associated guidance:

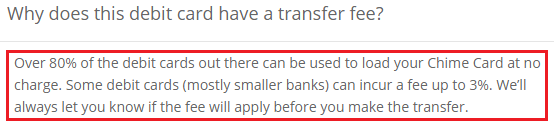

Extent you desire having a deposit are linked with your credit score. If you have a rating away from 580 otherwise above, you will need to put down 3.5 % of the purchase price. In the event your rating falls in the five-hundred-to-579 variety, you’ll need to lay out 10 % of the cost.

Mortgage insurance policy is mandatory and you can includes one another an upfront superior from the closing in addition to month-to-month or yearly home loan insurance rates repayments. Premiums normally increase towards longevity of the loan in the event the down payment is less than 10% and eleven many years if the downpayment is actually 10% or even more.

Your debt-to-earnings ratio-the amount of money your debt in place of how much money you create, such-can be higher while the 50 percent. Yet not, of several loan providers think 43% a less dangerous, common figure to own acceptance.

Bodies lay financing restrictions a year. To own 2021, FHA loan caps is actually $356,362 in the most common areas and you can $822,375 in more pricey parts.

Great things about an FHA Mortgage: FHA loans are prepared as much as let those who may not has actually the majority of credit rating or perhaps the currency getting a great 20-per cent down payment purchase of a house. The latest monetary standards is faster strict than others for conventional money, while making certification getting a keen FHA loan smoother.

Drawbacks regarding a keen FHA Financing: Compulsory financial insurance is an additional expenses that usually extends better outside of the 20-% equity draw of antique money.

Considerations to possess a keen FHA Mortgage: The latest FHA home appraisal assures in addition to that the home possess a monetary market price in line with the price but as well as that house is structurally sound, hazard-free and you will livable into identity of your own home loan. This type of appraisals can be found in spot to include people plus loan providers, very appraisals can get cite troubles otherwise irregularities that suppliers need resolve otherwise remediate before closure.

For additional info on FHA Financial certificates and to look for if you are eligible, get in touch with the professional financial originators now.

The conventional Financial

Traditional home loans aren’t regulators-guaranteed. Instead, personal otherwise commercial loan providers underwrite her or him if you meet its style of application for the loan standards. Standards typically follow direction set by Fannie mae otherwise Freddie Mac computer, for example, getting requirements eg down money and you can financial obligation-to-income percentages while you are loan limitations always pursue Federal Homes Loans Government information.

not, criteria for conventional financing are a tad bit more demanding in certain components if you are being laxer in other people:

Your credit score must be at the least 620, but if you have an excellent 740 or better, you’ll get the best interest rates and you can conditions offered.

You should use a traditional financing to acquire all sorts of property-much of your home, the next household otherwise vacation property, instance.

To possess a down-payment, you may be in a position to put down as low as step 3 percent, however, loan providers can offer most readily useful interest levels centered on large off payments such as the traditional 20 percent.

A downpayment regarding 20% of your own purchase price or appraised well worth allow you to end individual home loan insurance-PMI-premium. If you have to expend PMI 1st, you might miss they after you cross brand new 20-per cent security tolerance.

Financing limitations go after Fannie mae and you will Freddie Mac advice to have compliant in the place of low-conforming finance. To own 2021, conforming financing are capped at the $548,250 for the majority portion and $822,375 for lots more high priced parts. Nonconforming otherwise jumbo financing are designed for customers to acquire property cost beyond their area’s really worth limitations.

Old-fashioned finance provide so much more personalized has eg conditions-31, 20 or fifteen years, instance-otherwise sorts of money, like fixed-speed rather than changeable speed.

Great things about a conventional Loan: Getting customers who have a substantial credit rating plus the economic information to place off an effective 20-% deposit, old-fashioned fund give very competitive interest rates, zero PMI and you will different financial lending options be effective for problem or time period.

Cons off a conventional Mortgage: Customers need certainly to set out more money upfront on off percentage. Meanwhile, debt-to-income percentages and credit ratings are key from inside the determining interest rates and you may qualification.

Considerations to own a normal Loan: The fresh appraisal techniques for traditional financing addresses the fresh new property’s market price regarding similar qualities just. To establish a good property’s soundness or defense, people must initiate her inspections and exercise research so you can guarantee repairs or remediations try done before closing.

All of our home loan gurus would love to take you step-by-step through this new conventional loan process. Get in touch with them right now to discover more.

Consider Your property Home loan Options

If you are thinking of buying a property and looking to possess a financial, the sort of loan you choose must be a beneficial fit for your finances. If you’re happy to learn more about your house mortgage alternatives, Los angeles Capitol Government Borrowing from the bank Union’s mortgage experts may help. Contact Los angeles Capitol on line otherwise visit us now, and let us help you make an educated choice for your second domestic get.