Ready to get a different sort of home but not sure how to go about providing home financing? At the Solarity Borrowing Connection, we know you will need to has as much information that you could before making biggest financial behavior. Very, if you’ve ever considered lost racking your brains on mortgage brokers, you are in luck. Given that advantages, we’re ready to help. Here is how you could be eligible for lenders for the Washington State.

Which are the standard requirements so you can be eligible for mortgage brokers inside Washington County?

Before you apply to own Washington State home loans, you really need to gather the required information and you can records. Once you’ve all this in a position, you could potentially get home financing and you can fill out the data so you’re able to a loan provider. The lending company will make sure what you’ve considering and, if necessary, require facts/documents.

Identification. You’ll need to be capable confirm your term, so has actually among those records in a position. These may is your driver’s license, passport, Personal Protection amount or other authoritative types of photo ID.

Housing history. The rental otherwise homeownership records is even expected. You’ll need your target and addresses from somewhere else you’ve lived-in during the last 2 years.

The way you intend to make use of the ordered assets. Additionally have to let a prospective financial understand what sort of property you intend to make use of the loan having. Meaning specifying if or not this really is intended to be most of your household, a secondary house, a rental or something more.

You’ll also have to give particular individual monetary information, together with proof earnings, lender comments, the earlier years’ taxation statements, current financing information and much more. A loan provider allow you to know exactly what is actually requisite and can even also provide a record. Let’s look closer from the these types of requirements.

Monetary advice

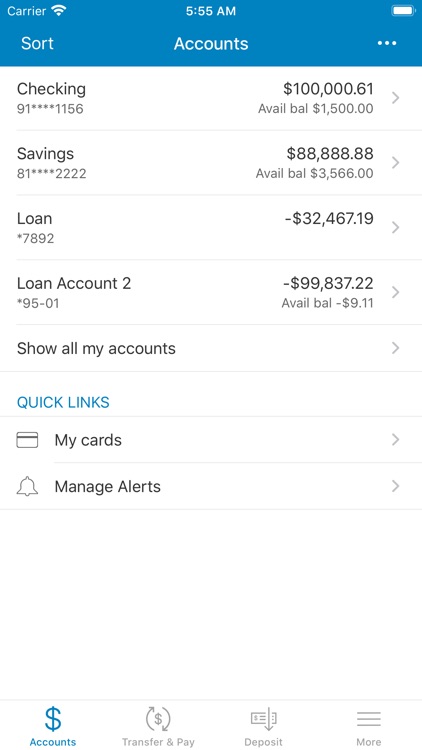

When you find yourself looking to get a washington County mortgage, you need two months off current monetary comments able. Be prepared to divulge costs and property also whenever you have previously submitted for bankruptcy. Possessions become old age accounts, IRAs, checking/offers profile, stocks, securities and you may equivalent membership.

If one makes month-to-month financial obligation payments, number this new stability, payment number plus the labels of one’s loan providers. Although this advice would-be available in your credit history, it is helpful for your lender to have that it in advance when you look at the buy to talk you from variety of anything you be able to pay for.

Evidence of income

You will want proof of money over the past 30 days. Usually, it means their several most recent spend stubs. It is critical to inform you the lending company which you daily features money arriving and can always, letting you build month-to-month payments with the the borrowed funds.

You will need certainly to let you know proof of income over the past 2 years. A job and income background will likely be revealed giving going back two years out-of W-2s. While care about-employed, supply the earlier in the day couple of years from taxation statements and additionally associated schedules. Proof of earnings comes with overtime, payment and you may funds from 2nd jobs otherwise side hustles.

However, a career isn’t the merely proof money to provide. Let your financial know if you get these:

Debt-to-money ratio (known as DTI)

Your proof earnings and you will listing of costs will assist the bank influence the debt-to-money proportion (DTI). That is, this new percentage of the debt compared to the your earnings. DTI is another cure for let a lender see you could potentially reliably build monthly installments. It also provides them with a concept of exactly what portion of the earnings goes to certain charges and this exactly what will be available commit into the financing money.

How will you estimate your DTI ratio? Make sense all of your current typical, repaired monthly expenditures, split one to by the pre-taxation money and you may proliferate the quantity from the 100.

All the way down DTI wide variety function better. All the financial enjoys other standards, but for most, so you’re able to qualify for an arizona Condition home loan, the DTI proportion would be forty-five% or faster.

Credit score

As part of the process, your own lender is going to run your credit score. Credit scores try a sign regarding financial standing and you may creditworthiness. A top score teaches you is actually a reliable borrower who is responsible with currency and so are more likely to shell out it back. A reduced get can have indicated monetary inconsistency and habits off payday loans Bigelow Corners overspending rather than reliably and also make costs punctually.

Fundamentally, you’ll have a credit score out-of 630 or higher. However, if your very own is a little straight down, you might still be eligible for home financing. Have a look at authorities-backed loans and you can communicate with loan providers to explore the options.

You can alter your credit score. Or even need home financing quickly, making the effort to switch their get before applying having financing helps make a significant difference.

So what can I actually do to change my credit rating or down my DTI proportion?

There are a number of things to do adjust the borrowing from the bank and increase your credit score. These include:

These methods, specifically paying off costs, is help reduce their DTI, as well. To further improve one proportion, you can you will need to improve money. This may indicate requesting an improve, performing overtime otherwise carrying out an extra occupations.

Just how delivering pre-recognition getting home loans when you look at the Arizona Condition produces one thing smoother

Prior to trying so you’re able to be eligible for home financing, expose everything over to get pre-approval from your bank. This can benefit you in two suggests. Basic, it can make you a concept of simply how much family your can afford with your most recent cash. This can will let you shop for domiciles in your rate variety. Being pre-acknowledged and suggests providers and you may realtors you might be a significant and you can accredited consumer., Apre-recognition could be the difference between your give bringing acknowledged on a home or not.

Solarity Credit Union’s Home loan Instructions to possess Arizona Condition

From the Solarity, we think to make homeownership significantly more obtainable to get more some one. For example all of our services to really make the entire process more straightforward to see. Solarity’s Mortgage Books try right here for you every step away from ways. After you keep in touch with our Guides, they’ll go over your money and you may desires, which will give you a much better idea of the way the techniques really works, exacltly what the monthly obligations will be and more. Get in touch with united states now, and we’ll hook up you for the finest professional.

There are more information regarding Solarity and the variety of home loans for the Arizona County i have readily available by the investigating the webpages. Once you have followed new methods intricate above, you are able to apply online for pre-approval getting home financing and get started on your homebuying travels.

All of our pro Home loan Guides is actually here to simply help

There’s nothing our house Loan Books love over enjoying participants transfer to its dream house. We’re here to store one thing as facile as it is possible (also a completely on line but really custom techniques)!